The future of technology in personal finance is poised for significant transformation. Innovations in artificial intelligence and blockchain are set to enhance user experiences and streamline financial management. As mobile payment options expand, consumers will gain unprecedented control over their assets. However, the implications of these advancements raise critical questions about privacy, security, and the potential for inequality. Understanding these dynamics is essential for navigating the evolving landscape of personal finance.

The Rise of Artificial Intelligence in Financial Management

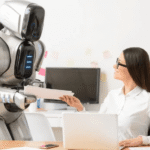

As financial markets become increasingly complex, the integration of artificial intelligence (AI) into financial management has emerged as a transformative force.

Automated budgeting systems streamline financial planning, allowing individuals to allocate resources efficiently. Meanwhile, intelligent investment algorithms analyze vast datasets, identifying opportunities that traditional methods may overlook.

This convergence of technology empowers individuals, granting them greater control and freedom over their financial futures.

See also: The Future of Technology in Consumer Electronics

Blockchain Technology and Its Impact on Investments

While traditional investment methods often rely on centralized systems and intermediaries, blockchain technology introduces a decentralized framework that fundamentally alters the investment landscape.

By enabling smart contracts and facilitating decentralized finance (DeFi), blockchain eliminates the need for intermediaries, thereby reducing costs and increasing transparency.

This shift empowers investors, granting them greater control over their assets and fostering innovation in investment strategies.

The Evolution of Mobile Payment Solutions

The evolution of mobile payment solutions has transformed the way consumers engage with financial transactions, reflecting broader shifts in technology and consumer behavior.

Contactless payments and digital wallets have emerged as pivotal tools, facilitating seamless transactions while enhancing convenience.

Personalized Financial Planning Through Data Analytics

Given the rapid advancements in data analytics, personalized financial planning has become increasingly accessible and effective for individuals seeking tailored solutions to their financial needs.

By leveraging data-driven insights, users can develop customized budgeting strategies that align with their unique circumstances and goals.

This approach not only enhances financial literacy but also empowers individuals to make informed decisions, fostering greater financial independence and security.

Conclusion

As the horizon of personal finance unfolds, the intertwining threads of artificial intelligence, blockchain, and data analytics weave a tapestry of unprecedented opportunity. These technological advancements act as guiding stars, illuminating paths toward financial autonomy and informed decision-making. In this brave new world, individuals are transformed from passive bystanders into active architects of their financial destinies, crafting a landscape where security, efficiency, and personalization flourish, ultimately reshaping the very fabric of financial management.

The Future of Work: How Technology Is Shaping Employment

The Future of Work: How Technology Is Shaping Employment